As the tide recedes, it exposes not only rocks, but also entirely new shipping lanes. The five-year super-boom cycle of the container shipping industry has come to an end. Over the next three years, the market will no longer be driven by a single, tsunami-like surge in demand. Instead, it will navigate a new sea full of structural challenges and opportunities amidst the triple dynamics of geopolitics, green transformation, and oversupply.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

Anchor of Demand: Slowing Growth and Geopolitical Reshaping of the Trade Landscape

After 2025, the container shipping market will first experience a "new normal" of demand growth. In its latest report, the United Nations Conference on Trade and Development (UNCTAD) clearly points out that global maritime trade is entering a period of "fragile growth, rising costs, and uncertainty." The organization's core forecast indicates that global maritime trade volume is expected to increase by just 0.5% in 2025, marking the slowest growth rate in recent years. This indicates that the market's fundamental drivers have shifted from a post-pandemic rebound to a weak growth trajectory, which is constrained by global macroeconomic conditions and policies. The two decisive forces behind this shift are geopolitics and trade policy.

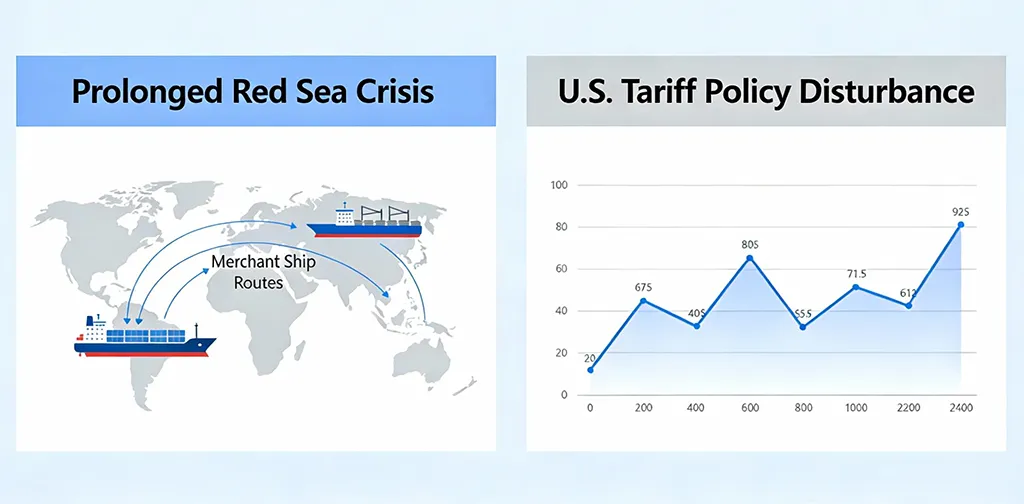

· The Protracted Red Sea Crisis: Ongoing tensions in the Red Sea and the Strait of Hormuz are forcing ships to take long detours around the Cape of Good Hope. These detours mean longer voyages of 10-14 days and soaring costs. More importantly, they permanently absorb 5-7% of global shipping capacity, which supports current spot freight rates and high fleet utilization rates. The industry generally believes that this situation is unlikely to be resolved in the short term.

· Disruption caused by U.S. tariff policy: The "Trump 2.0" tariffs have become the biggest source of uncertainty for trans-Pacific routes. They have created alternating shocks of "rush shipping" and "demand vacuums," causing US freight rates to fluctuate wildly. Analysts generally expect the impact of high tariffs to become more apparent in the second half of 2025 and 2026, which could continue to suppress US import demand.

Supply Peak: The Largest Delivery Boom in History and Structural Changes

In stark contrast to the fragile demand side, there is a certain and massive increase in supply. The market is at the beginning of an unprecedented new cycle of ship deliveries.

• Certain Capacity Peak: According to industry data, the average annual delivery volume of container ships will remain at approximately 1.9 million TEU from 2025 to 2028, with the peak delivery expected in 2027. Despite fleet capacity growing by 4.1%-1% in the first half of 2025, a greater number of new ships are waiting to be launched. This will lead to a fundamental imbalance between supply and demand: the estimated growth rate of fleet capacity in the coming years is 6.5%, which significantly exceeds the estimated growth rate of container trade demand, 3.5%-4%. Even if the Red Sea bypass absorbs some capacity, the potential oversupply pressure remains enormous.

• Structural Transformation of the Fleet: This wave of deliveries is not simply a matter of increased quantity. It is also accompanied by two profound changes.

a. Increased Vessel Size: Over 54% of the total capacity is accounted for by new orders for ultra-large vessels (17,000 TEU and above). Leading companies, such as MSC, continue to order 24,000 TEU mega vessels. This will create a "waterfall effect" on major routes, such as Asia-Europe, which will squeeze the market share of medium-sized vessels.

b. Green Fuel Transition: New orders for ships using green fuels, such as LNG and methanol, now account for 85.55% of total capacity. This is a necessary step to comply with the International Maritime Organization's (IMO) new carbon emission regulations and means future shipping costs will include a "green premium."

New Market Landscape: Differentiation, Volatility, and Alliance Restructuring

Due to the interplay of these forces, the market after 2025 will exhibit the following characteristics:

Extremely Differentiated Route Performance:

· US Route (Trans-Pacific): Directly affected by tariff policies, demand is weak and freight rates are under the greatest pressure. Freight rates from Shanghai to the U.S. West and East Coasts have already shown a significant downward trend in the second half of 2025.

· Europe Route (Asia-Europe): The Red Sea bypass provides strong support, and freight rates are relatively firm. However, this route is also most vulnerable to the impact of concentrated deliveries of ultra-large vessels.

· Regional and North-South Routes: Performance may be relatively stable and could become a new battleground for liner companies to deploy capacity overflowing from trunk routes.

· Normalization of freight rate volatility: "Pulse-like" price increases driven by events, such as geopolitical conflicts and tariff policies, and "protracted" declines caused by oversupply, will alternate. The market will transition from unilateral market conditions under the supercycle to a "new normal" of high-frequency volatility.

• Increased industry concentration and alliance reshuffling: Leading liner companies will solidify their advantages by placing large orders. MSC's capacity exceeds 6.7 million TEUs, and its market share exceeds 20%. Its leading advantage continues to widen. The dissolution of the 2M alliance and the emergence of new cooperation models, such as the "Twin Star" alliance, are reshaping the competitive landscape of the market.

Shipper's Action Guide: Building a Resilient Supply Chain Amidst Change

In a more volatile, complex, and buyer-driven market, shippers must adjust their strategies to transform challenges into opportunities.

· Transition from "Securing Space" to "Managing Volatility": Capacity shortages will no longer be the norm. Companies should shift their core task from securing space to managing freight rate fluctuations and supply chain timeliness uncertainty. More flexible, multi-source transportation solutions must be established.

· Deepen data analysis and contract strategy: Utilize future market bargaining power fully. When signing long-term contracts, strive for favorable terms. Consider placing some cargo in the spot market to capture opportunities amidst volatility. Establish tracking and early warning mechanisms for key variables, such as tariff policies and the situation in the Red Sea.

· Embrace a Green and Digital Future: Recognize that "green shipping" is about more than just cost; it's also about future market access and brand value. Collaborate with logistics partners who can provide end-to-end digital visibility to address complex route networks and potential congestion.

· Choose insightful partners: Future logistics partners should offer more than transportation; they should also provide in-depth market insights, flexible solutions, and robust compliance operations. They should be able to help you understand the impact of geopolitics on shipping routes and plan optimal routes and cost structures.

______________________________________________________________________________________________________________________________________________________________________________________________________________________________________________________

The cyclical laws have never failed; only the driving variables have changed. In the container shipping market after 2025, geopolitics replaced the pandemic as the biggest external disturbance, green transformation went from elective to mandatory, and capital-driven behemoths await orders to be filled with cargo.

In this era, successful shipping is not just about getting from A to B, but also about planning the most resilient and cost-effective routes amid both certainty (e.g. fleet growth) and uncertainty (e.g. policy changes and conflicts). This requires shippers and logistics providers to establish closer, more data-driven and trusting partnerships than ever before.

Cycles are perpetual; tides rise and fall. Those with foresight navigate steadily. While some companies only see fluctuations in freight rates, others, such as LOADSTAR SHIPPING work with their clients to map out entirely new supply chains in a volatile market. This transforms cyclical market fluctuations into a solid foundation for long-term competitiveness.

Ultimately, when the tide finds a new balance, those who recognised the change early on and adjusted their approach accordingly will be the first to take advantage of the new situation.